san antonio tax rate 2021

San Antonio River Authority 0018580 Alamo Community College 0149150 School Districts ISD - Alamo Heights 1193400 ISD - Boerne 1204600. County officials project a 19 percent increase in revenue because of a tax on new properties and an increase in property valuation throughout Bexar County said Leni Kirkman the University Hospital Systems vice president of strategic.

Texas Sales Tax Small Business Guide Truic

39 rows 2021 Official Tax Rates.

. Divide Line 16 by Line 24 and multiply by 100. 2021 NNR tax rate. SAN ANTONIO ISD School Districts Name Phone area code and number School Districts Address City State ZIP Code School Districts Website Address.

Bidding. The property tax rate for the City of San Antonio consists of two components. Boards.

Maintenance Operations MO and Debt Service. 48 rows San Antonio. Tax Code Section 260126.

Tax Code Section 2601214 2Tex. School taxes typically are the major component of a homeowners annual property tax bill typically ranging from about 50 to 60 percent of the total. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate. Dist was deleted in 1993 existed for 1991 and 1992 only. To avoid an election the city would have no choice but to reduce the citys portion of the property tax rate.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. 2021 Official Tax Rates Exemptions Name Code. The current total local sales tax rate in San Antonio TX is 8250.

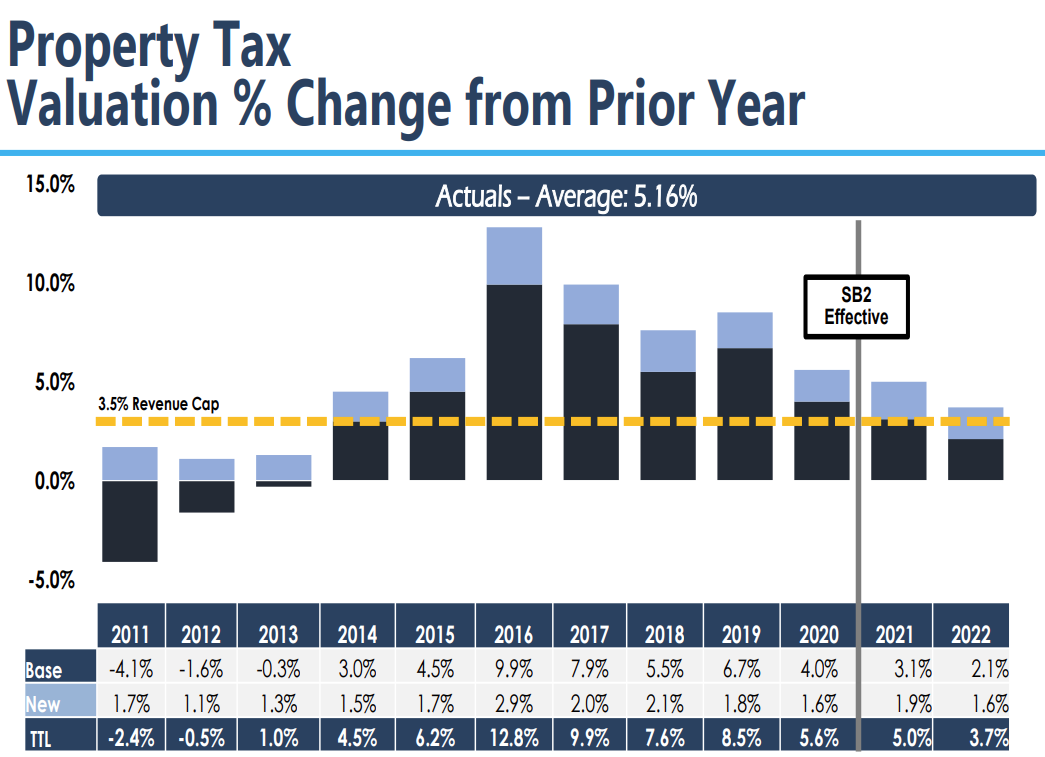

Total to be paid from taxes in 2021. Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

State Criminal Justice Mandate. San Antonio TX 78205 Phone. 2021 NNR tax rate.

Tax Code Section 2601214 2Tex. Tax Code Section 260126. 6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. A public hearing on the proposed tax rate will be held on tuesday september 14 2021 at 600 pm at the. SOUTH SAN ANTONIO ISD School Districts Name Phone area code and number School Districts Address City State ZIP Code School Districts Website Address.

The December 2020 total local sales tax rate was also 8250. The FY 2022 Debt Service tax. 188740 Total debt levy.

The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation. Tax unit 86 - timber creek annexed by the city of san antonio since 1980 tax unit 97 - co ed. The is rate will remain at its current rate of 03809.

311 City Services. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. Set by state law the homestead exemption for all Texas independent school districts currently is 25000.

19070447 Amount added in anticipation that the unit will collect only 9902 of its taxes in 2021. It is a 019 Acres Lot 1831 SQFT 4 Beds 2 Full Baths in San Anton. Divide Line 16 by Line 24 and multiply by 100.

The minimum combined 2021 sales tax rate for san antonio texas is. 6830 N Forest Crest St San Antonio TX 78240 is listed for sale for 295000. City Council Staff.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. The current total tax rate in nisd is the lowest it has been in over 10 years. 2020 actual tax rates 2021 actual tax rates as of 02232022 tax rates bexar county city of san antonio incorporated cities school.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 2020 ACTUAL TAX RATES 2021 ACTUAL TAX RATES As of 0223. San Antonio collects the maximum legal local sales tax.

There is no applicable county tax. 2021 Official Tax Rates Exemptions. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Published by at January 3 2022. 2020 Official Tax Rates Exemptions.

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tax Rates Bexar County Tx Official Website

County Commissioners Vote To Decrease Property Tax Rate In 2022

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio City Council Approves 2022 Bond Package San Antonio Chamber Of Commerce

Texas Sales Tax Guide For Businesses

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Explore Pass Member Benefits Rewards Seaworld San Antonio

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity